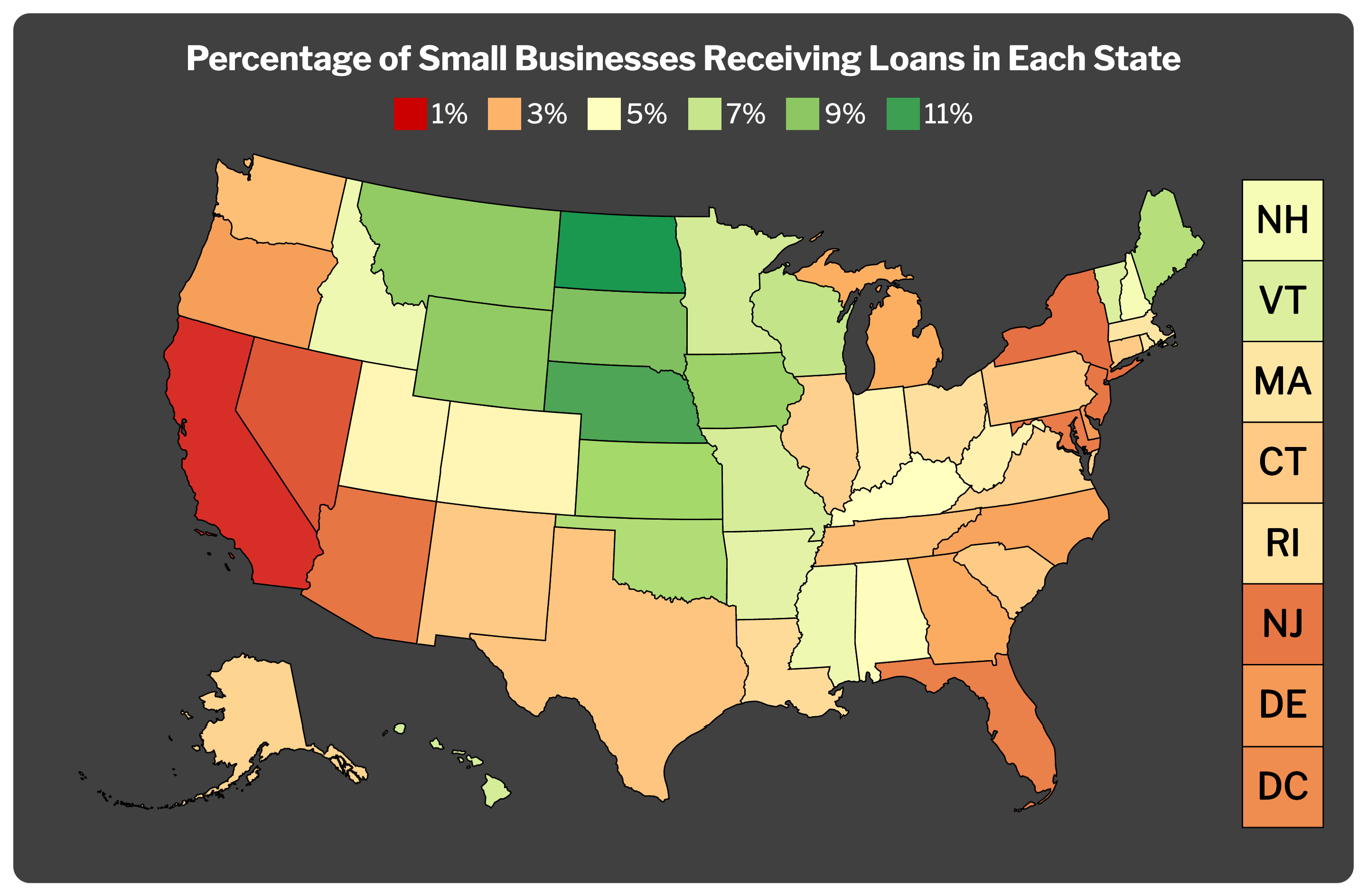

Casey and Adam Donner each own a small business in Lincoln, Nebraska. She is a makeup artist for the bride to get the camera ready to help their big day. Her husband has 30 employees of his construction company. Both companies have been churning out together if the new crown crashed on US soil, bringing much of the economy to a standstill and sending 22 million Americans and counting on the unemployment rolls. Casey thunder services – such as in salons, hairdressers and tattoo parlors in the state – were suddenly no longer allowed to keep operating. Construction is still allowed in Nebraska, so Adam Donner has managed to keep his crews to work. But fear is doing to keep plans when what the economy should be in six months to see you can not tell, he says. Earlier this month, the Thunder is bundled package successfully in March $2.2 Katherine stimulus for federal guaranteed loans to small businesses apply through their local bank. If they keep their doors open and their employees on the books of a pandemic, the principal on the loan will be paid by the government; in other words, it can be free money. The $349 billion of euro program is to give some hope of recovery the company has planned economic stimulus package if you have been shuttered for health reasons or if they have the doors open in the face of an economic downturn maintained. “It ‘a blessing, because we are able to move forward,” says Adam Donner, 39. “This is a shot-in-the-arm for us, and it was quite easy to get.” Geography The Donners’ can give them has, at least for now, a leg. Small businesses in the Midwest have developed an outsized share of the small-business loan program design for their lights to continue giving an analysis finds patterns in time. More than any other region, the distance between North Dakota and Kansas in the west and east to Ohio exceeded borrow coast for small businesses. The average small business in Nebraska were five times more likely to get on the right track a small business loan under the program, like his colleagues in New York, the epicenter of the current outbreak COVID-19. While most states have provided the largest dollar amounts of the program, with the flows of money in Texas and California, to test the percentage of small businesses that receive loans in a state paint, get a very different picture. In Nebraska, 18,565 of about 175,000 small businesses, according to the data in 2018 the Small Business Administration, received loans or 10.7% nationwide, second only to North Dakota. In New York, by comparison, this figure is 1.9%, the third to last off California and Nevada. The protection program paycheck was not going to help companies develop in the communities, in order to keep up with the worst outbreaks crown, but the economic impact of a crisis throughout the economy to mitigate spray. But the unequal distribution of program resources has followed a pattern in which a disproportionate amount of money has been placed in position when fewer people are currently sick while small businesses have been the hardest hit as New York and New Jersey, not He has been able to access funds anywhere near the same rates. It ‘impossible to say with certainty why the companies in the Midwest have been so successful for getting these loans. is the small business program applications access to participating banks they were processing the loan, and pulled the money out the door. At the same time, dragged benches in the Small Business Administration in Washington to let them know what the federal government has been guaranteed now. for only the places hardest hit by the virus may have been pre-assigned by the public health crisis, to find out how to access the program. Another factor could be that Midwesterners is already willing to cooperate with the federal government because of their experience access to agricultural subsidies and disaster relief following floods and tornadoes. Then there is the reality of the continuing economic crisis in 2008: rural America has lagged behind me city in the nation, in terms of recreation, and economic uncertainty is never far below the surface. This can act quickly motivated small business owners. But the most common explanation is offered by scientists and lay people that bankers in smaller communities in the Midwest may have been better understand the needs of their neighbors, helping its customers prepare in advance the paperwork. “We expect that, in general, the rural nature of the smaller states be disadvantageous in many ways, but it seems in this case, perhaps less population density and a higher density of attendance allowed actually an agile response, personalized and efficient” says Elizabeth Legerski, associate professor of sociology at the University of North Dakota. In other words, know your neighbors paid. Take, for example Barry Schweer. He is a branch president Nebraska 13 Heartland Bank positions. Even before the toner on March 27 was a right guaranteed loans which they authorize, Schweer banging on doors and mailboxes fill their corporate clients to make them aware of the program would come on line. He knew the mom and pop shops in his community would need help. His is the largest bank 13 in Nebraska, but was 70 loans can be filled within two weeks. “In our large cities, these small businesses surely the bank’s bread and butter,” says Schweer. “Once we realized that the program has come out, phone calls, text contacts – whatever it was – we were in touch with our customers.” He still has four or five applications on his desk that has not eliminated before the racing program from cash on Thursday, but he hopes that Congress approves a proposal for a second round of cash, those remaining in the first, helping crashes Washington. Union Bank & Trust, a private lender Nebraska with 38 locations, held its open credit department 24 hours a day in which the loan program started. At the end of the bank – ranked according to their credit in place 202 of the Federal Reserve – National elaborated in the early days of the second largest volume of loans that applications were open and that the aid more than 2,000 companies before the money dried up. “We knew that a large volume would come soon. We collected our employees around our customers for help,” says T. J. Casady, a vice president of the bank, the serialized small business loans program. “It ‘a real personal relationship that many of us have with our customers. They are our neighbors, and our friends.” However, despite the good neighborhood, a deep-rooted fear of the economic future of closed shopping centers and major roads remain in this part of the country, even if they do get loans. “I can not’m positive they will all survive, I mean, even with this help,” says Schweer. A trade war with China to perform agricultural exports from the Midwest. low cost energy has fueled the economies that the 2008 recession exposed to air within precious natural gas deposits discovered on the plains. While Wall Street is booming in recent years, he has seen profits destroyed last month a job ten years without signs of ending. March’s seasonally adjusted unemployment rate was scattershot for the region, with North Dakota reporting lower the nation’s unemployment rate, at 2.2% to 5.5% of Ohio. Across the country, the number was 4.4%. The Midwest awareness have contributed to his difficult economic realities entrepreneurs to properly access more loans, says former Senator Heidi Heitkamp, who for years has been to study for the next democratic country in the region as a potentially fertile ground and win. “If you look at those countries that are now on the highest percentage [of small business loans], are places that have economic burden, he says.” Rural America has never shared in the prosperity of the recession. “Not everyone buys this theory. “I find it hard to believe that these were small businesses were in some way faster than many small businesses very smart apply in cities and metropolitan areas, so that there is something inherent in the region are skeptical, “said the democratic strategist Isaac Baker, a former adviser to Treasury Secretary Tim Geithner and Barack Obama 2012 re-election effort. in both cases, the political importance of small business in this part of the country is likely to have not gone lost on President Donald Trump, who signed the stimulus package into law last month. Among the countries that fared better than the national average for loans, 11 are p er expected to be competitive when Trump tries to win a second term in November. Trump was on helping small businesses in this week already a campaign and Democrats blame for not more than $250 billion from the Fund for approval, as the program finished the money. “Democrats additional funds for the popular security program Paycheck block,” he tweeted on Thursday. “They kill American small businesses. Stop Dems do politics!” For people like thunder, politics is secondary to their needs of small businesses. In these uncertain times, every dollar is a rescue. “Everyone I know applied,” says Adam Donner. “If the government offers money like that, you take it.” Copyright Image

Related Post

Consultant Trump Kelly Anne Conway leaves the White House, citing family

Director of the White House Kelly Anne Conway, one of the longest-serving helper President Donald Trump is leaving the government at the end of the...

Friends and family of Joe Biden Convention: The Democratic Party takes a step Emotional

There were a dozen leading Democratic candidates spent most of bickering debates about the nuances of the different health care plans. You probably do not...

John Lewis was the person like Christ I’ve ever known

I was changing into my second year at Georgetown Law School, when John Lewis History march across the Edmund Pettus Bridge in 1965. Governor George...

blacks voters under age 30 may decide the fate of Joe Biden – by sitting out the election

This article is part of the DC short, the time newsletter policy. Subscribe to stories like this sent to your mailbox for every day. Overall,...

impose Trump for $44,100 in legal fees Stormy Daniels

(Los Angeles) - to pay porn star Stormy Daniels to court in California ordered the president Donald Trump this week $44,100 for their legal dispute...

President Trump says he wants to stop funding for electronic message arrest vote

President Donald Trump has stepped up its attacks on mail voting on Thursday, when he appeared to say clearly what he has instilled in months:...