When the popular government program small businesses cover the overhead line during the pandemic crown back on Monday, thousands of Main Street companies were lined up for the 10:30 start gun. By 01:00 on Tuesday, banks had $52 billion dollars in loans to small businesses backed by the federal government shoveled out the door. With the close of business on Wednesday, more than $90 billion have been distributed. Struggling to Paperwork businesses around the clock to process loan applicants intensively working capital needs has had through the country’s bankers – and fight government servers crashed under the demand to keep up. The Small Business Program, the Paycheck Protection Program (PPP), the brand, is one of the largest financial injections for the US economy in history. The program initially ran $349 billion worth of funding in 14 days, and the second tranche of $310 billion, which approved last week, is on track to do the same. Money is another 5,300 separate banks without much direction from Washington has borrowed to get the money movement. Yet, to date, taxpayers have the historical record footers have no way to know who gets the money. and shame or bullied into something of their loans to return the money – – the government body the enormous funds must be monitored nor any list of documents Although some large companies that have the recipients were filed by the Securities and recipients Exchange Commission were identified. Although the updated information is now available in all that sectors and countries were the largest program winners during the first round of funding, it may be months before any public accounting full accommodate assumes got that money and for what purpose . “We lack a critical time. All the money out the door,” says Liz Hempowicz, director of public policy at the Project on Government Oversight, a control group not deployed. “It ‘a very direct question, that vigilance is being done right now.” Stay up to date on the growing threat to global health, by signing up for our daily newsletter crown. questioned the Paycheck Protection Program provides eligible companies with fewer than 500 employees, non-profit organizations and independent loans from private lenders, which will be awarded if the companies hold steady their payrolls. In other words, companies can free up unneeded workers carry a certain amount to stop the spiral of direct unemployment of 26 million and counting. The loans, which went under the first amount of money shelled program excluded for banks and smaller minorities. If Congress replenished the fund last week, once again, these concerns have resulted in spin-off to help smaller banks to participate and the potential favoritism clearing banks to larger customers, better equipped. On Wednesday, even as the well-known program that only banks with assets of less than $1 billion could submit documents after midnight between 16:00 pm and midnight, so that smaller banks have another advantage, and computer servers a break. But no visibility in real time when funding is more, it is impossible to know whether the second tranche of the money is to avoid the malice of the first. Immediate information on how the money is spent, have not been made part of any agreement to Congress the first or second round of spending. The government, after all, had a lot on his plate and there were legitimate concerns that rapid disclosure could put your thumb on the scale of the competition. Some borrowers have been identified to be filed with the SEC, but the mom and pop shops that have been considered are the main beneficiaries of the program is not regulated there. “We know that they do it publicly at some point. But they have not made it easy so far,” says Jordan Libowitz, director of communications for citizens to responsibility and ethics in Washington, a progressive control group. For the moment, the most recent public accounts of the program, published on the Ministry of Finance website, the title money until April 16 breaks loans dispersed by government and industry, but not the loan recipients identified and only identified the largest funder of the program by a number (for example, a lender with no name had an average loan amount of $515,000). The Small Business Administration (SBA), the federal agency on the hook, the banks for repayment, offers a bit ‘more information on the size of banks, the loan from the most recent fund, but do not know who he is. Ultimately, perhaps the answer pandemic Accountability Committee, a body in another law be determined the best source of solid information on the problems that the security program Paycheck established. After President Donald Trump urged the prime leader of the committee in a bureaucratic momentum off-side, has an interim president beginning, the top watchdog of the Ministry of Justice, and has hired an assistant high this week on business. Who received aid under the part of aid packages every three months to report on the pandemic panel details about the money and what it is used for. The plate, in turn, has 30 days to ask for public criticism online. But the neighborhood does not end until June 30. Most of the information could happen perhaps to some of the first companies in late July or early August to be to go to help small businesses. Congress also created the Office of the Special Inspector General at the Department of the Treasury, a new watchdog dedicated to monitoring where the dollars go pandemic. The post, however, requires Senate confirmation. Trump White House attorney Brian D. Miller, a former prosecutor and former inspector general selected. But he faces a hard mass in the Senate; Last year, Miller said the independent Government Accountability Office (GAO), which the White House for his work with his investigation into the decline of security assistance for Ukraine – the event to which Trump impeachment and acquittal earlier this year at the center. If Miller wins confirmation, he will build his office from scratch. Congress did not include emergency language for the new watchdog to monitor a separate fund $500 billion to help companies that fall outside of the SBA loan program. This means Miller or someone else run the office staff comparing rushes bureaucratic routine for adjustment. Miller is simply brings with him his inner circle of not being able and positions must be booked well. The prolonged process inevitably means lost opportunities for politicians and legislators geeks tinkering with the programs as they are the most beneficial and effective way to pump more money into the economy under siege. Right now, Congress is considering a further aid package, but has yet to see what the first two vases of small businesses gave money. “The bottom line is that this pandemic will be with us for a long time,” says Austin Evers, founder of the American supervision, a liberal group that the administration Trump flavored with the investigation and litigation for public records. “It ‘s unlikely that this is the only financial support that companies and individuals will receive. If we were not in the data output as the first tranche can see, we do not have the necessary tools for the future.” Some in Washington are ready to begin the checks directly to the local relief fund and pull back to cut it from the lender. Sen. Cory Booker, DN.J. and Senator Steve Daines, R-Montana, worked with Rep. Dan Kildee, D-Mich., proposed $50 billion that would give local pools of money with the aim of supporting small businesses with fewer than 20 employees and those with fewer than 50 employees in poor neighborhoods. “Surveillance programs to work better,” said Kildee. “This administration and these banks will be able to achieve their goals more effectively when they know someone is watching and measured. If no one is watching and measure things get sloppy.” Others have a longer view. Former GAO assistant director John Kamensky notes that Congress already to the side so far put $280 million into a plan for pandemic response and increased the GAO budget of $20 million, in addition to creating the treasure to the Special Inspector General, and the pandemic response Responsibility Committee. On top of that, it comes to a panel of the 9/11 Commission, House Democrats own investigations and have robust surveillance operations on the hill. “The transparency we will, I think,” says Kamensky, the eight years spent trying former Vice President Al Gore’s Reinventing Government initiative advise and is now a senior fellow at the IBM Center for the business of government. “It ‘a matter of getting on time and do it clean.” Please send tips, leads and stories from the front to [email protected]. Picture copyright by Christopher Occhicone Bloomberg / Getty Images

Related Post

Consultant Trump Kelly Anne Conway leaves the White House, citing family

Director of the White House Kelly Anne Conway, one of the longest-serving helper President Donald Trump is leaving the government at the end of the...

John Lewis was the person like Christ I’ve ever known

I was changing into my second year at Georgetown Law School, when John Lewis History march across the Edmund Pettus Bridge in 1965. Governor George...

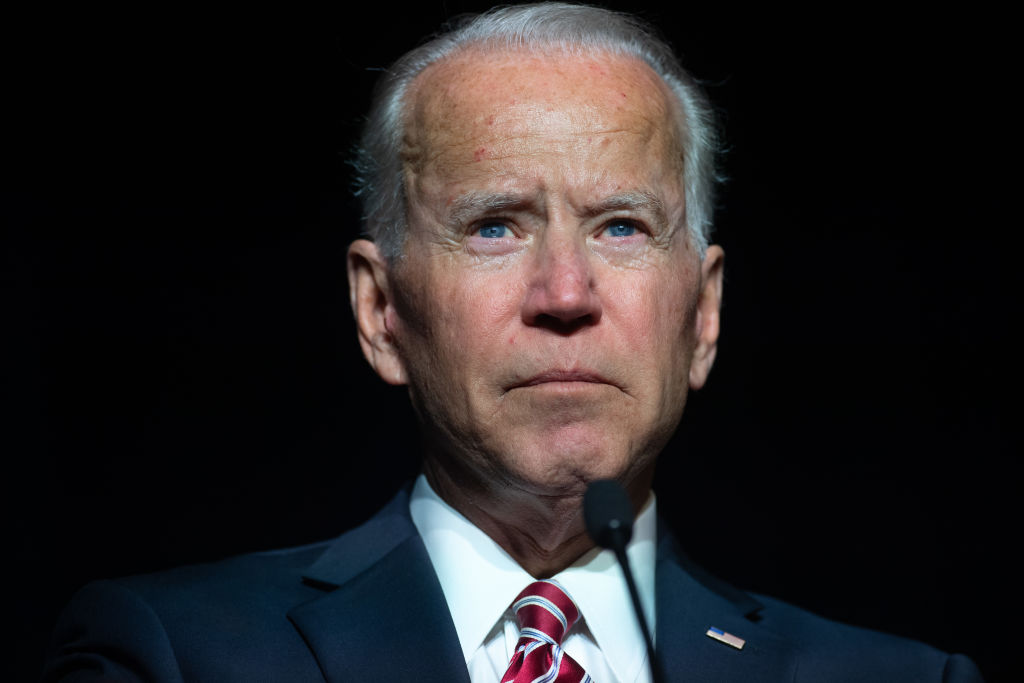

Friends and family of Joe Biden Convention: The Democratic Party takes a step Emotional

There were a dozen leading Democratic candidates spent most of bickering debates about the nuances of the different health care plans. You probably do not...

blacks voters under age 30 may decide the fate of Joe Biden – by sitting out the election

This article is part of the DC short, the time newsletter policy. Subscribe to stories like this sent to your mailbox for every day. Overall,...

impose Trump for $44,100 in legal fees Stormy Daniels

(Los Angeles) - to pay porn star Stormy Daniels to court in California ordered the president Donald Trump this week $44,100 for their legal dispute...

President Trump says he wants to stop funding for electronic message arrest vote

President Donald Trump has stepped up its attacks on mail voting on Thursday, when he appeared to say clearly what he has instilled in months:...