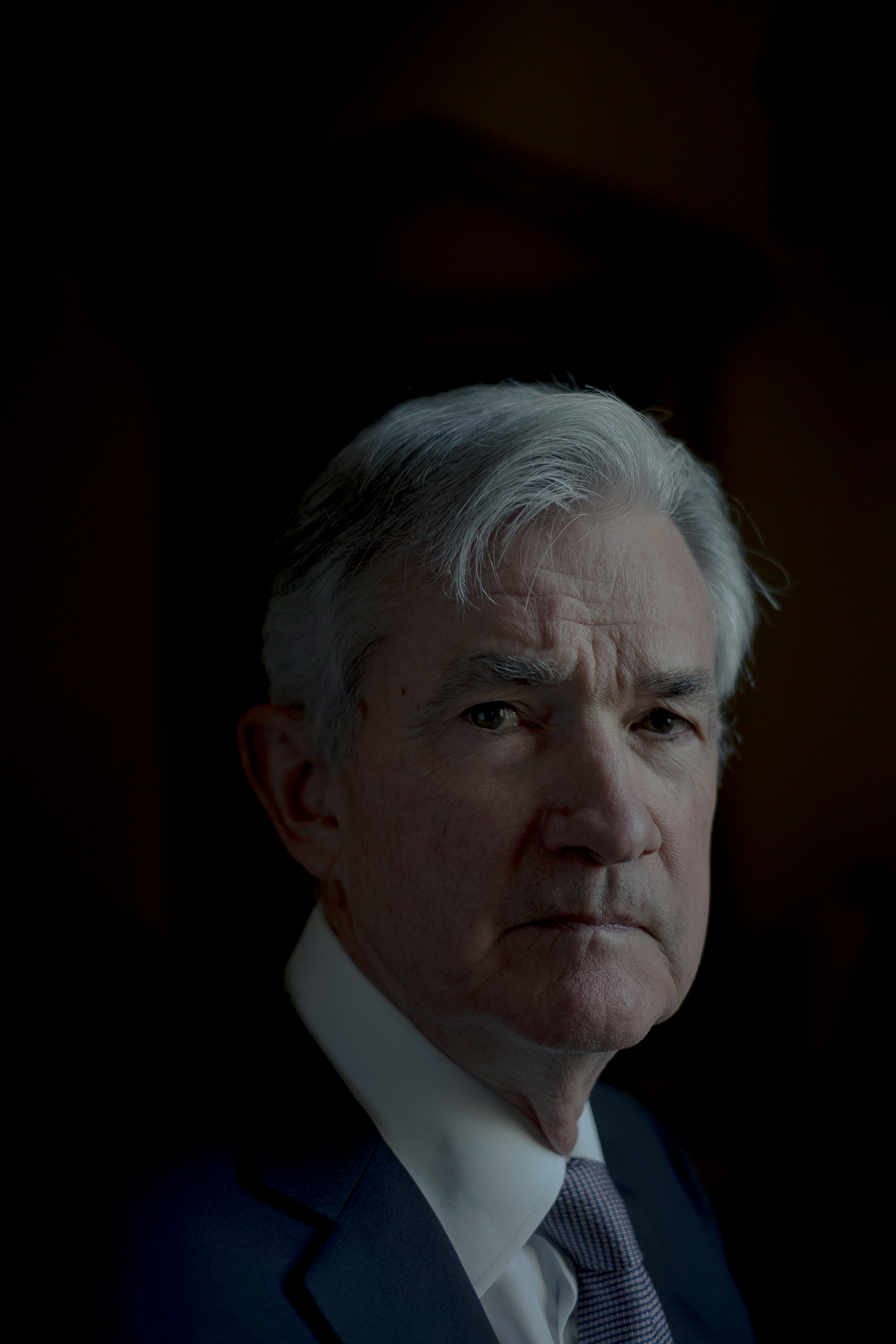

On March 11, a group of traders the opportunity to see in New York Federal Reserve Bank, in real time, as financial markets spiraling downward. The market was panicked that day. The stocks were about 20% from its peak in February down, and the ground seemed in sight. Since the pandemic began Crown Roman role across the country and try to damage near biblical in paid market might cause. Dealers Fed has had to try the unenviable task of making sense out of chaos. They met around a table, their coffee carefully, notes and talk to their colleagues across the country. The New York team was the eyes and ears of the central bank on the market, and their reports were gloomy. Even the ultra seizure markets. Buyers and sellers were having a hard time to even determine an award for the most important assets. This was a crisis. The information gathered in New York were then passed on to Federal Reserve Chairman Jerome “Jay” Powell. Before the markets closed on March 11, Powell made a surprising announcement. the Fed was ready to print half trillion dollars the next day to offer short-term loans to borrowers in difficulty on Wall Street. The next day, the Fed would provide another $500 billion in short-term loans (the so-called loans repo) market. A trillion dollars, offered on two days, the Central Bank equivalent of a campaign “shock and awe”. There was every reason to believe that this would work. The Fed’s power is based on the simple fact that it is the only institution in the world, the US dollar remove air (what we call a “dollar” is actually a Federal Reserve Notes). But on March 12, the Fed through the crown was outmatched. Even the US $1,000 billion does not calm the nerves of traders. They are worried that all the printed money in the world could not give people the courage to go to Chipotle or cinema. printed money can not be kept open, the shops along Fifth Avenue in Manhattan. other markets crash. In view of this panic, Powell and the Fed rolled out a second, even larger, wave actions in late March and early April, prompting the central bank into new business areas, its scope expanded dramatically and closer than ever before weaving into the fabric of American economic life, now the Fed is a guarantee for large areas of the American economy and world. Not a place where Powell expects to find it. “To develop my views with the evidence,” Powell said in an interview time in early May. The evidence before him these days is scary, and must take steps Powell led Fed that seemed unthinkable just a few months ago. The epidemic Crown must destroy in a few months, swept away about a decades worth creating jobs, about 20 million positions from the end of May and the unemployment rate pushing to its highest levels since the Great Depression. The crisis has burdened the financial markets around the world and the companies that are already burdened with record levels of debt. It caused a financial panic in March that was not fully appreciated at the time. The pandemic has ended with more speed and more power than perhaps any case in the history of the US economy. Powell And everyone is trying to make him stop. It ‘hard to describe the actions of the Fed without sounding hyperbolic. The Fed has printed money on a scale that dwarfs all previous efforts. Only the balance sheet, a rough indicator of how much money the bank has printed Fed to consider. After the financial crash of 2008, for example, the Fed added $1.4 Katherine to its budget in two years (a record increase at the time). This year, the Fed added $2900000000000 in less than three months. Back in 2007, the Fed’s balance sheet was approximately 6% of the size of the entire economy. By the end of this year it should be around 40%. Already in 2010, the Fed launched the second round of a controversial stimulus program of quantitative easing (QE) called, by which bought $600 billion of US debt over several months. In March, the Fed has bought about $543 billion dollars in one week from similar programs. In 2015, the budget $analysts 4,500,000,000,000th Fed met expect to take about $8 Katherine or more by the end of this year. Perhaps more importantly, the Fed is now working on different programs in direct collaboration with the Ministry of US Treasury on corporate bonds and small businesses to purchase loans. These new programs break down the walls of the supervised independence of the Fed. Just a few months ago, there was speculation that the Fed will have ammunition could run an economic recession to fight in part because it was so long kept interest rates so low, but Powell Fed has shown that they are ready, at a time of crisis is to launch new programs, expand its influence and take greater risks. The speed and chaos of economic collapse during the pandemic have obscured the impact of the Fed’s actions. Behind all the complex numbers and programs, the Fed simply rewriting the rules of American capitalism. In a few months, the bank has increased the size of its economy, the presence of more than two thirds and has been shown to investors would be to buy completely new types of things step that had never bought before, like junk bonds and corporate loans Main shopping street. As often happens at the Fed, this is all presented under the heading of crisis management, but history shows that the actions of the Fed are very difficult to escape once a crisis is over. The actions it took 2008-2010, presented as temporary, remain largely in place. And ‘quite plausible that the Fed a decade from now will the debate on emergency measures reversed today. No one should know that better than Powell. When he joined the Fed, he has expressed concern about the dangerous side effect of the emergency measures in the past decade. He tried unsuccessfully done before the back-scale pandemic some of these measures. Now is overseeing the operation more far-reaching in the history of the Fed. “I think it is unprecedented, even for the previous financial crisis,” said Treasury Secretary Steven Mnuchin on the role of the Fed. Powell and Mnuchin were one day on the phone, sometimes dozens of times a day, Mnuchin confirmed. Both Powell and Mnuchin have made it clear that they are ready to do more if the situation so requires, but insists that the emergency measures are temporary. “This emergency forces are, we can only use with the Secretary of the Treasury permission” and written under the Act of Congress, Powell says. “And when the emergency is over, we will put these new forces away again.” But as the Fed continues in various corners of the economy will continue to slide, make it harder, never quit and that concerns economists and critics, it is no wonder that this means for the economy in the future. “If you cross a line, it’s really hard to go back,” said Roberto Perli, a former senior economist at the Federal Reserve. “It will be very difficult, maybe not in the next recession, but the next crisis for the Fed not to say.” Powell recognizes this risk. “It is that we moved to a zone, the risk that we do not want long-term,” says Powell. “What is there for me to fear that some of us, these forces may wish more frequently to use, rather than only in an emergency like this is clear.” The Fed’s emergency measures have reshaped American capitalism says Scott Minerd, Chief Investment Officer of Guggenheim Investments, which advises the New York Federal Reserve Bank. “You have essentially told the world that there is now an attack on corporate bonds,” says Minerd. it will be impossible, “By directly between, [the Fed] has set a precedent, cancel … Now we have associated credit risk. And we always have changes the way our economy works” The private banking system has now a new calculation as it makes loans. The price of a loan is also based on the Fed’s appetite to buy. If it is a single mantra, driving Powell and the leadership of the Federal Reserve seems to be, it is that the Fed is on a war footing. The concern about long-term consequences of today’s actions should be put aside. In a situation like this, Powell and his team believe they have little choice but everything possible to save the greatest possible number of jobs to be done. “For this reason, the Fed has invented,” says former Fed President Janet Yellen. “It ‘was just a huge, broad flight from risky assets of all kinds. And that’s how a modern bank run. The role of a central bank is to take risks and to avoid damage to the economy when no one else is willing to do it. “When she arrives for the first time in 2012 at the Fed, Powell seemed interested in status quo questioning. Powell was nominated by President Barack Obama, who would appoint a Republican to an empty two seats on the board. The Federal Reserve is an institution that consent rates and civilization. It is noteworthy, then, that during the first meeting of Powell as a Fed governor, said things that were positive incendiary. It was January 2013. Output was the Fed’s increasingly comprehensive intervention in the economy. In 2008 and 2009, the Fed’s emergency lending during a global financial panic flows to keep. It took an even greater role in late 2010. At that time largely overcome the financial crisis, but the overall growth was weak. European governments must deal with the main problems of debt and tepid growth threatened to derail the recovery. It looked like it could do little because the Fed interest rates were near zero. The former head of the Fed Ben Bernanke has supported a radical technology. The Fed could be pumped into the banking system through the purchase of certain types of activities by large banks billions of dollars. This was the program of quantitative easing, and the experiment seemed to pay. added economic growth. Part of this growth was inevitable. But advocates said the program has helped to promote businesses to borrow money to hire workers and boost output used. It ‘also converted the financial markets. crashed early as August 2008 before the stock market, US banks held about $2 billion euro excess cash in reserve accounts at the Fed, an insignificant amount. By the end of 2012 the amount was in excess reserves swelled to $1.45 Katherine a historical anomaly meant by many factors of 10. This is the day that the Fed simply increase the cut in interest rates in a recession, and growing, they had disappeared. Things had become more complicated. The Fed had injected hundreds of billions into the banking system, while keeping interest rates near zero, to give them the behavior of the affected banks instead of saving through the promotion. Many critics of QE stressed that all the money has created desperate importance “for the rise of search” that banks, pension funds and hedge funds needed to invest excess liquidity and were willing to invest only on something more than 1% or 2% succumbed. This search for yield was to create a classic speculative bubble recipe. This type of bladder is exactly what Powell again in early January 2013. He warned at the time was something of an outsider. Unlike many Fed officials Powell is not an economist. He is a lawyer who has spent his career back and forth between two worlds: the government service and private equity transactions. His experience gave him a firsthand look at the way the Fed intervention could distort credit markets, and was worried about what he saw. “While financial conditions have a net positive, there are also reasons to be concerned about the growing market distortions created by our asset purchases in progress,” Powell said, according to a transcript. “Many fixed income securities act now well above the baseline, and the eventual correction could be as large and dynamic.” Language In Fed might consider these fighting words. Powell said that the value of assets such as fixed rate bonds has been inflated by QE. Under the pressure of Powell and other governors of the Fed was concerned about asset bubbles, Bernanke began publicly to signal that the Fed its QE asset purchases could drive again. Would investors panicked and began government bonds in the long term dumping, for fear that the market without making large purchases by the Fed QE fall. The Fed pulled back, worried that his movements could cause more damage. So it’s a difficult pattern for the Fed. Bernanke and then his successor, Yellen, and then his successor, Powell, all have tried to reduce the Fed’s asset purchases, raise interest rates and reduce the size of the Fed’s balance sheet , all with limited success. Every time the Fed tried to pull back, threat caused market volatility, declined to withdraw the pressure on the Fed. Powell has learned firsthand how difficult this process after could be president Donald Trump of Fed Chairman has appointed in 2017. in December 2018 Powell during a press conference, said to be that the Fed’s QE process to reverse by pulling down on the Fed’s balance sheet has been committed. “So we thought carefully about how to normalize politics and came to the conclusion that we have effectively the net outflow on autopilot would and use monetary policy, interest rate policy for the incoming data to adjust,” he Powell said during his public statements. The “auto-pilot” of this statement got the attention of Wall Street. Powell said the Fed determines its presence in the financial markets to reduce. This is not going well. The stock market began to Crater, and the Dow Jones fell more than 600 points on Christmas Eve, a frightening event on a quiet day in general. Given the market turbulence, unlike Powell essentially in prices in January. “As always, there is no predetermined path for the policy,” he said during a public appearance. “And especially with subdued inflation numbers that we see coming, we will be patient as we look to see how the economy develops.” Restoring markets. But the Fed had committed in principle to the intervention work and permanent pumps money, only the financial system. This commitment became evident in September of last year. This is when a major Wall Street credit market is called the withdrawal agreement or repo, market is taken. loans repos are designed to be inexpensive and safe. People borrow money in the market for repurchase of sound guarantees, the creation of such as treasury bills, and in return get cash. These loans could be as short as one day. Back borrower swaps pay the money for bills, a small premium for the privilege at that time. repo markets allow investment firms to quickly make their assets in cash, and are the lifeblood of Wall Street. But something went wrong with this market in September 2019. From September 16 to September 17, the cost of ready-term loans against needle than usual by about 2.5% rate over 9%, a shocking level that attracted traders and the Fed by surprise. It is unclear what exactly caused this market attack, but some things are certain. The Fed’s efforts to “normalize” its operations have excess bank reserves for about $1.4 Katherine full. This level of excess bank reserves over 100,000% more than in the decades before 2008, but they were not high enough to keep the market repo. Banks were unwilling to extend loans or repo capable. Most repo borrowers were “non-bank players”, such as hedge funds, according to Bank of America analyst Ralph Axel. For some reason the banks were not ready this hedge fund repo loans to offer, even at inflated prices. On September 17, the New York Federal Reserve intervened. It ‘about $75 billion available and up to $100 billion in loans Night repurchase at below market prices. These cheap loans allowed the hedge funds and to maintain non-bank actors doors open. The repo markets subsided. However, in October, Powell announced that the Fed would buy billions of dollars in assets such as Treasury bonds and mortgage-backed securities. Overall, the Fed pumped more than $400 billion in financial markets. And that was the month of January in the good old days. Powell has been able over the years have argued that the Fed should downsize some of its operations. But Powell, and those who work with him are emphatically that he is not an ideologue. They say he has adapted his opinions based on data. He worked as much as in the world of private equity, is back for good measure the performance of a company against market judgments and make changes if necessary. On February 11, Powell said in public testimony before Congress that the Fed reports of a novel coronavirus in China was monitored. “We look carefully,” Powell said at the time. How many people these days, Powell is working from home, do the same hectic mixture of meetings conference calls and video conferencing that millions of Americans do. On the desk in his home office, Powell holds a useful thing for the constant reference: the key steps of the Dodd-Frank financial reform law of 2010. The law sets out how the Fed can use its emergency lending powers during a crisis , in collaboration with the Ministry of the US Treasury. This has become surreal sometimes Guide Powell. The current wisdom within the Fed points of aggressive and fast acting chief after former Fed economist Claudia Sahm. After the crash of 2008, the Fed has made a group of domestic politics its emergency response in 2009 “lessons learned.” With the study and come Fed officials came to believe that the bank was slow to respond to the housing bubble and then slow to respond when the bubble bursts. “The lesson of the Great Recession, if you do not move fast if you do not go big, you will have a mess,” says Sahm. “The best way that you can have a short-circuit the recession, and make it less serious, is just the beginning.” Powell seemed to take the lesson to heart. From 3 March to March 23, the Fed rolled out of his playbook from 2009, only bigger and faster than ever. It has cut interest rates to zero. It offered $500 billion in loans repurchase everyday term. You open the so-called swap agreements with foreign central banks so that the banks their currency for dollars at a stable rate act. The Fed ramped up quantitative easing machine, promising substance for an unlimited number of treasury bonds to buy until further notice. But these emergency measures were not enough to prevent the crash of markets. Minerd, Guggenheim Investor says the panic on the financial markets during this time broke out. Panic also swept the market for Treasury bills, probably the foundation of the global economic system. Minerd and others saw with horror the spread on Treasury bills jumped 4% on a matter of days in March. The price range for the most risky types of debt, such as corporate bonds, hit 30%. “And ‘unthinkable,” says Minerd. That was the type of flashing red signal, which is a financial crisis. Worldwide, downloaded investors regardless securities and assets that have had to increase liquidity in a desperate attempt. Spreads of enlargement titles showed that there simply is not enough money was to be worldwide. The Fed in 2009 playbook was not enough. On March 23, the Fed introduced a new series of interventions, it has announced three programs that greatly expands its reach in the economic landscape. Known as special vehicles or SPV these legal persons newly minted Joint ventures are created with the Ministry of Finance living within the Federal Reserve Bank. With the money the Fed and the Treasury of the SPV are used for a variety of activities, aufzuzukaufen that the Fed had avoided before buying. Corporate bonds was a particular concern. Companies such as Ford Motor Co. and the power Heinz took billions in debt when interest rates were low. When the crown was made of unmanageable debt burden. In March alone, about $90 billion dollars in investment-grade corporate bonds were written down to the junk debt, according to Deutsche Bank. This risked causing a cascading effect. Since the debt has been downgraded in the amount of more to trash companies, which could push back the investors for billions of dollars of junk another loan debt to waver or face causes of default. The Fed has created two new companies Vehicle corporate bonds and help in the short sale process. From April 9, the Ministry of the Treasury under the $75 billion between the two had put bond call SPV. Liquid assets of the taxpayer will act as the “first loss” of money that standard, when the bonds means the losses are first paid with the money of the Treasury. Another important SPV buys loans they received for companies with fewer than 15,000 employees. to subsidize loans to companies that were previously only in the private banking system has left an important starting point for the Fed. Mnuchin says the effort is already bearing fruit. “The day we announced jointly that TRANSACTION_ID and obligation to release, that the entire corporate bond market”, says Mnuchin. “So, without the need to invest a dollar from taxpayers’ money, it never unlocked the simple liquidity announcement and a stop unprecedented levels of activity.” Taken together, all these programs one goal. The Fed and the Treasury are joining forces to buy the debt when the private market is not willing to do so. The Fed will print new dollars to do this, and the debts are effective in the Fed’s balance sheet. Therefore, the balance is expected to be about doubled this year from about $4100000000000 before the crisis to $8000000000000 or more. The increase in SPV will merge the Fed and the Treasury in a more meaningful way from 1951 when the two agreed to a “coincidence” that together with the independence of the Fed. Since its inception, Fed leaders are worried that if the elected politicians pressed to get the money by printing the Fed’s power, they would simply machines run whenever the choice in front, after the creation of out-of-control inflation or asset bubbles. Powell is known to have this supervised independence, even as President Trump has made a goal for his Twitter rants, the Fed to cut interest rates under pressure and increase economic growth. Powell has been established that the Fed’s job to act independently, without regard for the upcoming elections. In 2014, when he was a Fed governor, Powell was invited to speak at the Brookings Institution, where scientists had suggested that the Fed coordinate their program to purchase bonds with the Ministry of Finance. Powell does not agree with this idea and called it “risky.” “I believe that monetary policy should be -independent, and this independence is for the company of great value,” Powell said at the event. “I have that any active cooperation between debt management and monetary policy during the crisis, to challenge the fear that independence risk.” The Fed and the Treasury are not working along the US debt to manage, but work together to flood credit markets with new money. Powell has stressed today that the Fed will remain fiercely independent when it comes to setting monetary policy and initiate programs such as quantitative easing. “It ‘s important that a democratically elected our government has the responsibility to share the responsibility for these emergency measures we take,” he says. “Dodd-Frank said the Treasury secretary must approve all these guidelines. I think this is a good policy, actually.” Although Powell, the Fed maintains the independence of the central bank is an increasing risk of political backlash against its new loan programs, said Kenneth Rogoff, professor of economics at Harvard University and former chief economist of the international monetary Fund. “I’m in dangerous territory, and they know it,” says Rogoff. The biggest risk is that people will always get upset when she became the Fed seen picking winners and losers in the debt markets, buying the debt of some cities and companies and not others. This resentment has been building. Sheila Bair, the former chairman of the FDIC, says the Fed will leave many profound economic problems to solve, such as the disappearance of millions of jobs and small businesses will want. “I think that the financial assets across the board are inflated by monetary policy. I think the markets have been distorted, because you know what is real and what is not. May be the stock and bond markets markets disconnected from the real economy, “says Bair. In fact, the shares have lost most of their value, and unemployment has increased significantly since the end of February again, and the economy officially advised recession. Many analysts, the market boom in much of the actions of the Fed. This reality is already causing tensions between the Fed and some lawmakers on Capitol Hill. When Powell and Mnuchin testified May 19 before the powerful Senate Banking Committee, Sen. Elizabeth Warren criticized both for financiers rather than rescuers. Reinforced Senator Sherrod Brown, the top Democrat on the Committee that the criticism in a statement to TIME. “The Federal Reserve over to help Wall Street and the companies in crisis situations, but behind him to get the leftist workers is always creative,” writes Brown. It seems unlikely that the new SPV Fed’s programs is the end of the intervention by the Bank. In a press conference on April 29, the pandemic still spreading, Powell reiterated that the central bank will be on hand to intervene if necessary. “I’m not done,” says Sahm, former senior Fed economist. He noted that the Fed has a list of emergency measures pending. The nuclear option says Sahm would be something that a cash funded budget program, known as the “helicopter money” with which the outputs of the US national debt, which the Fed keeps buying immediately and permanently. “It ‘s basically print only the Fed and money to pay for the relief,” says Sahm. Both Powell is the Fed pushed past this threshold remains to be seen. It ‘clear that Powell will examine the economic health of the same ideological flexibility has shown since he became president. The question is how far it is willing to go? Powell said that there is a limit to the intervention of the Fed. With the pandemic still rages around the world can only test the following year where the border is. Leonard is the author of Cook Country: The Secret History of Koch Industries and corporate power in America. Alexander Holt provided research for this story. This appears in the June 22, 2020 issue of time. Picture copyright by Gabriella Demczuk for TIME

Related Post

BIPOC entrepreneurs have harshly But pandemic save Hit with their work companies, but also to give back

When she café and bookstore opened in 2016, Zenat Begum created more than just a place to grab a snack and get something to read....

Facebook block Ailing man scheduled end of life transfers

Le Pecq, France - Facebook on Saturday banned live broadcasts of a man confined to bed chronically ill, and for a medically assisted suicide French...

Trump to China ByteDance plans to sell in the United States TikTok

President Donald Trump plans a decision on China ByteDance Ltd. based on the popular music of the video app TikTok United States rejected to give...

make our future work from home could make it easier to find jobs for some people, says the CEO Odesk Hayden Brown

If COVID 19-pandemic finally ends, it will probably be remembered as a time of great tragedy remembered. But like any global crisis, but also the...

India’s richest tycoon just passed the European rich after growing his fortune to $22 billion in 2020

Mukesh Ambani has passed the Europe increased richest man, making him the fourth richest man in the world. Reliance Industries Ltd. President is to accumulate...

YMCA CEO Kevin Washington balancing pandemic response and the financial pressure

(Miss this week is the short lead, this interview in the Mail leadership brief participants box was delivered on the morning of Sunday, July 19...